How a Home Loan Calculator Can Help You in Discovering the Best Mortgage Rates

Innovative Lending Calculator: Encouraging Your Budgeting Methods

In the realm of individual financing, the significance of reliable budgeting approaches can not be overemphasized. An innovative funding calculator stands as a device that not only facilitates the understanding of various lending choices however additionally aids in understanding intricate settlement routines. Its influence transcends simple numerical computations; it plays a pivotal role in checking one's financial health and, inevitably, in enhancing budgeting approaches. By harnessing the power of straightforward features, this calculator leads the way for a much more informed and equipped strategy towards managing financial resources. This tool's potential to change the means people navigate their financial landscape is indisputable, offering a glimpse right into a world where budgeting becomes more than simply number crunching.

Understanding Loan Choices

When thinking about borrowing cash, it is vital to have a clear understanding of the different finance choices readily available to make educated monetary choices. One usual kind of funding is a fixed-rate loan, where the rates of interest stays the very same throughout the financing term, offering predictability in regular monthly settlements. On the other hand, adjustable-rate lendings have rate of interest that rise and fall based on market problems, providing the capacity for lower initial prices but with the risk of enhanced settlements in the future.

An additional alternative is a guaranteed loan, which requires collateral such as a home or cars and truck to protect the borrowed amount. This sort of car loan normally supplies lower interest prices as a result of the reduced danger for the loan provider. Unprotected loans, however, do not call for security yet frequently featured greater rates of interest to make up for the enhanced danger to the lending institution.

Recognizing these car loan alternatives is crucial in picking one of the most suitable financing remedy based on monetary scenarios and specific needs. home loan calculator. By evaluating the pros and cons of each type of car loan, consumers can make knowledgeable choices that line up with their lasting economic objectives

Computing Repayment Timetables

To properly manage funding settlement obligations, understanding and properly computing settlement timetables is extremely important for maintaining monetary security. Determining payment routines includes identifying the total up to be settled occasionally, the regularity of payments, and the complete duration of the financing. By damaging down the overall car loan quantity into manageable regular payments, consumers can budget plan effectively and guarantee prompt payments, thus avoiding late fees or defaults.

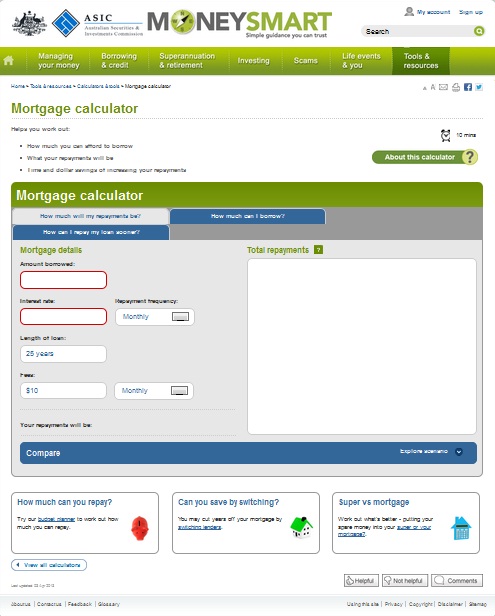

There are different methods to compute repayment schedules, consisting of the use of lending amortization schedules or online loan calculators. Lending amortization routines supply a comprehensive break down of each settlement, showing just how much of it goes towards the principal amount and just how much towards passion. On-line funding calculators simplify this process by enabling users to input finance information such as the major amount, rates of interest, and car loan term, creating a payment schedule instantly.

Comprehending and determining payment timetables not only aid in budgeting but additionally supply debtors with a clear overview of their financial commitments, allowing them to stay and make enlightened choices on the right track with their settlement responsibilities.

Tracking Financial Health

Monitoring financial health entails frequently analyzing and analyzing one's monetary condition to make certain stability and educated decision-making. By keeping a close eye on essential economic indicators, individuals can recognize possible problems early and take proactive procedures to address them. One vital facet of keeping an eye on economic wellness is tracking earnings and expenditures (home loan calculator). This includes developing a budget plan, classifying expenses, and comparing real costs to the allocated amounts. Inconsistencies can indicate overspending or economic mismanagement, triggering modifications to be made.

Frequently evaluating investment profiles, retirement accounts, and emergency funds can aid people gauge their progress towards conference monetary goals and make any kind of required adjustments to maximize returns. Monitoring financial obligation levels and credit ratings is likewise important in evaluating general monetary wellness.

Taking Full Advantage Of Budgeting Strategies

In optimizing budgeting methods, people can take advantage of various strategies to enhance monetary preparation and source allocation efficiently. One trick approach to maximize budgeting methods is with setting clear monetary objectives. By developing particular goals such as saving a specific quantity each month or minimizing unnecessary costs, individuals can align their budgeting efforts in the direction of attaining these targets. Furthermore, tracking expenditures diligently is critical in recognizing areas and patterns where adjustments can be made to enhance the budget plan better. Making use of technology, such as budgeting applications or financial administration devices, can improve this procedure site web and give real-time insights right into investing practices.

Moreover, focusing on cost savings and investments in the spending plan can assist people safeguard their financial future. By designating a part of income towards cost savings or retirement accounts before various other expenses, individuals can develop a security net and job in the direction of long-lasting monetary security. Looking for professional suggestions from financial coordinators or consultants can additionally help in optimizing budgeting approaches by obtaining tailored advice and expertise. Overall, by using these methods and remaining disciplined in spending plan management, individuals can successfully enhance their financial resources and achieve their financial goals.

Using User-Friendly Features

Conclusion

In conclusion, the innovative lending calculator offers an important device for individuals to recognize loan alternatives, determine settlement routines, display monetary wellness, and make best use of budgeting techniques. With user-friendly functions, this tool empowers users visit here to make enlightened financial choices and prepare for their future economic goals. By making use of the funding calculator effectively, individuals can take control of their financial resources and achieve higher economic stability.

Keeping track of economic wellness includes frequently examining and assessing one's economic condition to ensure stability and notified decision-making. On the whole, by utilizing these techniques and remaining disciplined in budget management, people can effectively enhance their monetary resources and achieve their financial objectives.

In final thought, the cutting-edge loan calculator offers a valuable device for individuals to understand loan options, determine payment routines, display monetary wellness, and make best use of budgeting methods. With easy to use functions, this device encourages customers to make educated monetary choices and plan for their future financial objectives. By using the funding calculator properly, individuals can take control of their funds and achieve greater economic stability.